Our decision intelligence platform does what you need it to do. Period. If you’re looking for a solution to enhance your risk management and anti-financial crime efforts–without breaking the bank–then look no further.

Download our whitepaper on combining entity resolution and graph technology for cost-effective, advanced contextual decision intelligence ↓

A platform that adapts to your needs

Anti-Money Laundering

Know Your Customer

Fraud Investigations

Master Data Management

Single Customer View

And More

Detect financial crime faster. Analyze smarter. Cut costs.

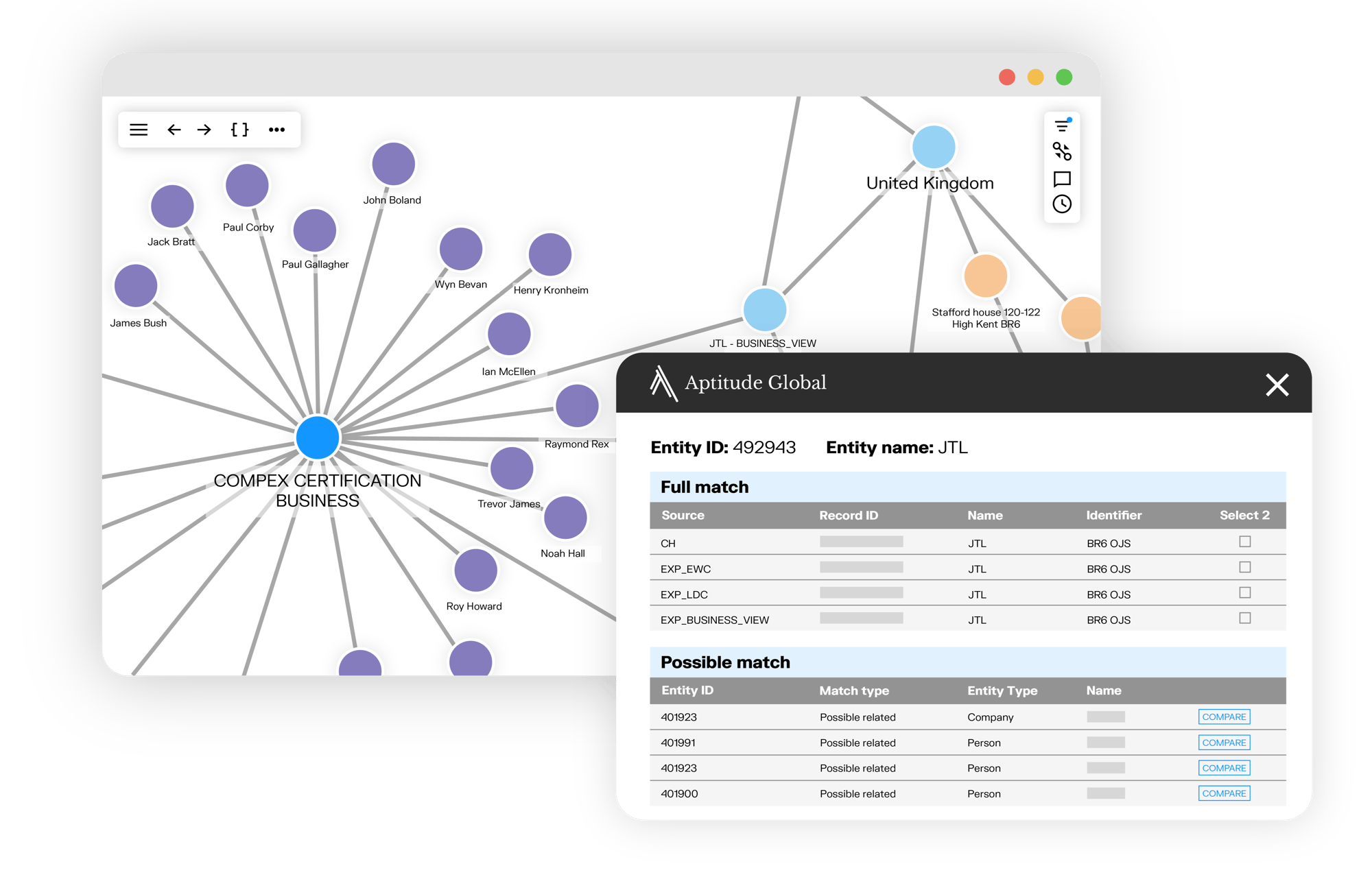

While other solutions may over promise and under deliver, our solution doesn’t. It’s been designed with the best-of-breed technology, combining both graph analytics to provide a complete view of your data and entity resolution to ensure you're gaining trusted insights every step of the way.

Our promise is simple–to provide our users with the reliability, flexibility and ease-of-use needed to gain time to value: faster implementation, improved process efficiency, enhanced financial crime detection and risk mitigation–all at a fraction of the cost.

Easily leverage advanced alerts that will monitor your connected data to spot even the most complex networks - be it money mules, synthetic identities, or something altogether different - and prevent illicit activity from slipping through the cracks.

Tap into the power of graph technology and entity resolution to break down data silos and enhance data quality to get a complete view of the full context around a client or transaction–leading to improved financial crime identification and trusted decision making.

Quickly adapt to new and changing requirements and collaborate across your team or organization at large with a flexible, scalable and modular solution that works the way you do and with the tools you already know and love. It’s a future-proof investment.

Your decision intelligence platform should work the way you do.

Not the other way around.

Unlike other solutions, our open and modular approach is fully configurable offering faster implementation, unparalleled flexibility, seamless integration with existing systems, and effortless maintenance to ensure your autonomy every step of the way and a lower total cost of ownership. But we’re not just here to provide a tool; we remain your trusted partners with advanced expertise in data management - ready to assist whenever you need us.

Our Approach

Key Figures

£100m

In operational cost avoidance demonstrated at a Tier-1 Bank

80%

Reduction in manual case reviews by moving to perpetual KYC

30-85%

Automation of KYC remediation checks at a Tier-1 Bank

35%

Reduction in average handling time for CDD file build

2.5

Hours to resolve over 20 million customer identities

80%

Reduction in investigation time for complex cases

Data is your best asset - its quality should reflect that.

Our decision intelligence platform integrates seamlessly with your existing architecture and operates with automation and data quality at its core - keeping your data up-to-date and accurate, always. Its flexibility ensures it grows with your requirements and interoperability allows you to integrate seamlessly with trusted 3rd party data sources.

Best-in-class Entity Resolution at its core

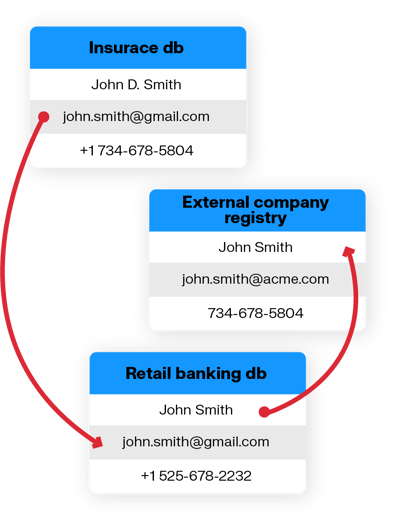

Whether you're dealing with multiple internal or external data sources such as sanctions lists, company registries, or more, fully understanding the context of your data points will only ever be as good as its quality. Add to that challenges around data variations, temporal data changes, data entry errors and intentional misinformation, deriving accurate insights can start to feel like an uphill battle.

But it doesn’t have to be. With advanced entity resolution capabilities you’re able to gain a more accurate understanding of the context of your data and identify potential risks with increased efficiency.

Our real-time capable Entity Resolution solution takes the complexity out of resolving entity data from any number of sources. Scalable to billions of records, the AI-powered self-learning, self-correcting and fully language agnostic Entity Resolution engine provides the confidence that traditional record matching Master Data Management tools struggle to deliver.

We focus on data quality so you don't have to.

Combining Aptitude's industry experience and technical know-how with Linkurious' product suite we can help clients use that insight to build highly performant anti-financial crime solutions, achieving significant cost savings and operational performance gains.

Sameem Jaffrey

Co-founder | Aptitude Global

Graph algorithms can be used to identify bad actors, for example money mules or incidences of identity theft. Giving analysts the ability to execute these detection rules automatically and visualize and explore the results means less time is spent organizing and preparing data and more time applying their vast experience to identify genuine cases of fraud and financial crime.

Alan Brown

Chief Technology Officer | Aptitude Global

The future-proof solution offered by Aptitude Global using Linkurious technology offer a real opportunity for a variety of organizations to supercharge their anti-fraud and financial crime arsenal at a fraction of the cost of other solutions on the market.

Sébastien Heymann

CEO | Linkurious

.png)

-1.png)

In partnership with

Aptitude is a specialist Data Solutions provider with innovation and automation at their core. They apply a 'Business First' approach to solving complex Data problems for their clients across regulated industries such as financial services, legal, pharma, and energy.

Senzing entity resolution software allows you to quickly add the most advanced data matching and relationship discovery capabilities to your applications and services. No experts required. With their easy to use API, you can be up and running in minutes and deploy in days or weeks.